Fed milestone: Central bank raises rates, plans to shrink its $4.5T in assets

WASHINGTON--The Federal Reserve raised its key short-term interest rate Wednesday, held to its forecast of another hike this year and announced a plan to shrink its $4.5 trillion asset portfolio in a move that will push up long-term rates over time.

The plan to unwind the balance sheet, beginning this year, represents a milestone in the eight-year-old recovery as the Fed grows increasingly confident the economy can move forward without the extraordinary support it has provided since the 2008 financial crisis.

"We continue to feel the economy is doing well," Fed Chair Janet Yellen said at a news conference.

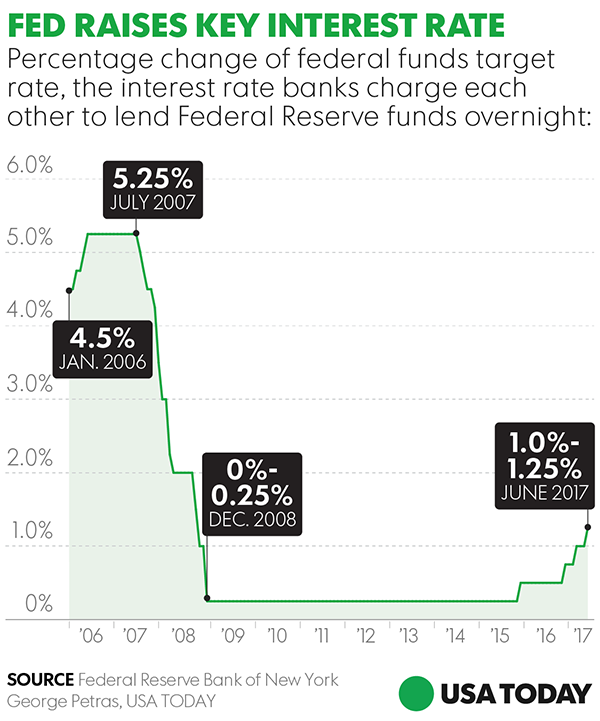

Despite a recent downshift in economic growth and inflation, the Fed lifted its benchmark short-term rate by a quarter percentage point to a range of 1% to 1.25%. It marks the second such hike this year and third since December. It's another vote of confidence in a recovery that, while sluggish, has whittled the unemployment rate to a 16-year low of 4.3%.

The move is likely to have a domino effect on borrowing costs throughout the economy, in particular nudging up variable rates for credit cards, home equity lines of credit and adjustable-rate mortgages.

Learn more: Best credit cards of 2023

More on how the Fed rate hike will affect consumers:

Why your credit card debt is about to get more expensive

Will a rate hike mean more interest in your savings account?

What it means for mortgage rates and home buyers

How much will it impact your next auto loan?

The market reaction to the central bank’s decision was mixed, as investors reacted to a Fed that seems intent on following through with a third rate hike later this year despite another weak reading on inflation last month and 0.3% drop in retail sales in May.

The Dow Jones industrial average climbed more than 46 points to a record close of 21,374.56. The broader Standard & Poor’s 500 stock index dipped 0.1% to 2437.92, while the tech-dominated Nasdaq continued its recent rough patch with a decline of 0.4% to 6194.89. Longer-term U.S. government bonds rose in value despite talk of another Fed rate hike, pushing the yield on the 10-year Treasury down to 2.06%, its lowest level since the day after the presidential election.

The Fed’s message was a tad less market friendly than expected. It appears less “data dependent” than it has been in the past and more inclined to continue pushing rates higher and off of emergency-low levels, Tim Kearney, an asset allocation analyst at Voya Investment Management, told clients in a note. Kearney says another rate hike could come as early as the Fed’s September meeting.

Meanwhile, the Fed will begin to gradually unload the $3.5 trillion in Treasury bonds and mortgage-backed securities it purchased after the financial crisis to lower long-term rates, a campaign that swelled its balance sheet to $4.5 trillion. It's taking pains to do so cautiously because signals that it intended to merely taper those purchases caused Treasury yields to spike in 2013.

The Fed has said it will set gradually increasing caps on the amount of assets that roll off its books each month as they mature. Initially, the cap will be just $6 billion a month for Treasuries and $4 billion for mortgage assets. The cap for Treasuries will increase by $6 billion every three months until it reaches $30 billion monthly within 12 months.

The cap for mortgage securities will rise by $4 billion every three months until it reaches $20 billion monthly within 12 months. So, within a year, the Fed will be shedding $50 billion a month in the assets, more than some analysts expected.

Still, the plan, Yellen said, "is consciously intended to avoid creating market strains."

And Fed officials have said its balance sheet likely will level off at about $2.5 trillion to $3 trillion in a few years, significantly above the pre-financial crisis level of about $1 trillion.

The Fed didn’t say when it will begin rolling off the assets, but Yellen said, "We could put this into effect relatively soon."

Vincent Reinhart, chief economist of Standish, believes the central bank will announce the first step in the process in September and raise rates for the third and final time this year in December. That would give it breathing room in the summer and fall to assess whether the economy and inflation have rebounded enough to warrant that third hike.

"The risk of an adverse reaction in the markets (to a reduction in the Fed's portfolio) should be minimal," says economist Paul Ashworth of Capital Economics.

The Fed left its forecast for the federal funds rate intact, projecting a third quarter-point increase in 2017, based on policymakers’ median estimate. The Fed marginally lowered its estimate of the rate at the end of 2019 to 2.9%, close to its long-run level of 3%.

"We're not moving so aggressively as to put a brake on continued improvement in the labor market," Yellen said, "But I think it's prudent to move in a gradual way" to head off an eventual run-up in inflation."

Policymakers slightly raised their economic growth forecast for this year to 2.1% but kept the estimates for 2018 and 2019 unchanged at 2.1% and 1.9%, respectively. With unemployment falling sharply recently, they pushed down their prediction for the jobless rate at the end of both next year and 2019 to 4.2% from 4.5%

And since price increases have softened in recent months, the Fed reduced its estimate for its preferred measure of inflation — which excludes food and energy costs — to 1.7% from 1.9% for this year. But it expects inflation to drift back to its annual 2% target over the next two years.

Despite the recent downturn in the economy, inflation and job growth, the Fed said “the labor market has continued to strengthen and that economic activity has been rising moderately so far this year.”

It did, however, note that “inflation has declined recently” and noted that it will be “monitoring inflation developments closely.”

Some Fed policymakers have suggested the blueprint for rate increases may be too aggressive in light of recent economic weakness. The economy grew at an annual rate of just 1.2% in the first quarter, nearly half the already tepid 2% average throughout the eight-year-old recovery.

And the Fed’s preferred measure of annual inflation dropped to 1.7% in April while the core reading that excludes volatile food and energy costs fell to 1.5% after both indicators had edged close to the central bank’s 2% target early this year. On Wednesday, government reports showed that in May a different inflation measure was weaker than estimated and retail sales unexpectedly tumbled. Fed rate increases could further slow inflation.

Still, several Fed officials have said they believe the slumps in growth and inflation are temporary. The government has struggled to measure economic gains early in the year because of challenges making seasonal adjustments. And inflation has been suppressed in part by the unlimited plans recently rolled out by the wireless carriers.

Wage growth, meanwhile, has picked up but not as much as economists have anticipated amid a 4.3% jobless rate that’s making it tougher for employers to find workers. Still, Fed officials have voiced confidence that the low unemployment eventually will hasten pay increases and inflation, prodding the Fed to get ahead of the curve by gradually lifting interest rates.

Fed policymakers are trying to make sense of other economic crosscurrents as well. President Trump’s proposed tax cuts and infrastructure spending — both of which could juice the economy and inflation — have been bogged down by concerns about how to pay for them and delayed by probes into his ties with Russia.

While that could give the Fed more leeway to lift rates slowly, financial markets seem unfazed by the Fed’s rate hike plans, with stocks near all-time highs and Treasury yields barely above 2%. That runs counter to the Fed’s aim of cooling off the economy a bit to prevent a run-up in inflation and it theoretically provides policymakers some room to hoist rates more rapidly.

Yellen deflected a question about whether she would be interested in being reappointed by President Trump to serve as chair for another term after her current one expires in January.