The most tax-friendly state for you? It depends.

In retirement, when every single dollar of income counts, moving to a tax-friendly state – a place where you’ll get the most after-tax income possible – makes a good deal financial sense.

But the most tax-friendly state for you and your household will depend on your sources of income and how states tax that income, be it Social Security, earned income, a traditional defined benefit pension plan, income from assets in IRAs, Roth IRAs and taxable investment accounts, or some other type of income.

What’s more, you’ll have to determine how state and local sales tax (especially if plan on being a big spender in retirement), state and local property taxes (some state and local governments offer exemptions), and state estate taxes affect your family finances as well.

“You want to look at the big picture,” Rocky Mengle, a senior state tax analyst at Wolters Kluwer.

You also want to understand the current state tax treatments of retirement benefits, which can be a key step in deciding where to establish new, post-career roots, according to a recent Wolters Kluwer report. Read Deciding Where to Retire: Finding a Tax-friendly State to CallHome.

Where to start?

Start with your sources of income. Determine what percent will come from Social Security, earnings, assets, and a pension. Once you know that, you can screen in or out certain states based on your personal facts and circumstances.

At present, earned income represents 32.2% of total income for the average Social Security beneficiary; pensions, 20.9%; Social Security, 33.2%; and income from assets, 9.7%. At the extremes, however, shares of income from each source differ greatly by income level.

For instance, the largest share of income for households aged 65 and older in the lowest income quintile – those with income less than $13,499 – comes from Social Security benefits (80.7%), cash public assistance provides the second largest share (9.5%) and income from earnings, assets and pensions is just 7.8%.

And for retiree households in the highest income quintile -- those with income more than $72,129 -- earnings provide the largest share of income (45.2%), pensions provide the second largest share (22.3%), and Social Security and asset income (15.4% and 14.0%) are similar in importance.

Note also that this exercise could be time-consuming. The tax treatment of retirement benefits varies widely from state to state.” For example, some states exempt all pension income or all Social Security income,” according to the Wolters Kluwer report. “Other states provide only partial exemption or credits and some tax all retirement income.”

Will earned income represent the largest share of retirement income?

If you plan to work in retirement consider moving to a state that doesn’t tax individual income – retirement or otherwise. At present, there are seven states that fit the bill: Alaska, Florida, Nevada, South Dakota, Texas, Washington and Wyoming.

Of course, before you load up the truck and move to one of these seven states, calculate your overall tax burden as well as your sales tax or property tax rates, as well. For some, the amount paid in property taxes might offset the savings from not having to pay taxes on individual income.

You should retire here: New survey names the 5 best states to retire in

Of note, many states and some local jurisdictions offer senior citizen homeowners some form of property tax exemption, credit, abatement, tax deferral, refund or other benefits. These tax breaks also are available to renters in some jurisdictions. The benefits typically have qualifying restrictions that include age and income of the beneficiary.

Also of note, this exercise of calculating which states provide the greatest after-tax income works especially well for high-income taxpayers, but less so for low- to moderate-income taxpayers, says Mengle. Also, older Americans should factor in to their calculations the likelihood that they will stop the to their stop working around age 70.

The Tax Foundation and the American Institute of Certified Public Accountants’ Total TaxInsights have online tools to help you calculate your overall tax burden, sales tax and property tax rates.

Mengle also suggests working with a tax professional who can perform what-if scenarios for different states. “Have them work up an individualized assessment on the states that are possible retirement locations,” he said.

What if Social Security represents a large share of income?

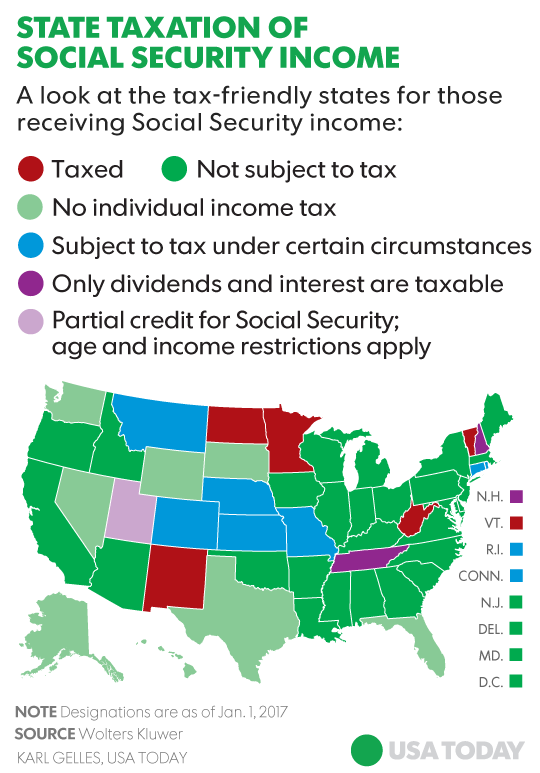

Retirees for whom Social Security represents a large share of income in retirement might want to avoid these 13 states: Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, North Dakota, Rhode Island, Utah, Vermont and West Virginia. Those states, according to Wolters Kluwer, either tax Social Security income to the same extent that the federal government does or provide limited breaks for Social Security income, often for lower-income individuals.

Pension income?

Retirees for whom a defined benefit pension plan represents a large share of income might avoid moving to Arizona, California, Connecticut, District of Columbia, Idaho, Indiana, Kansas, Massachusetts, Minnesota, Nebraska, North Carolina, North Dakota, Rhode Island, Vermont and West Virginia. Those states tax pension income. Meanwhile, retirees with pensions might consider moving to those states that exempt pension income entirely for “qualified” individuals (Illinois, Mississippi and Pennsylvania) or states that exempt or provide a credit for a portion of pension income (Alabama, Arkansas, Colorado, Delaware, Georgia, Hawaii, Iowa, Kentucky, Louisiana, Maine, Maryland, Michigan, Missouri, Montana, New Jersey, New Mexico, New York, Ohio, Oklahoma, Oregon, South Carolina, Utah, Virginia and Wisconsin).

Income from assets?

Meanwhile, if you have a large investment portfolio and expect the bulk of your retirement to come in the form of dividends and interest income, you might avoid moving to New Hampshire and Tennessee, both of which impose income taxes only on dividends and interest (5% flat rate for both states).

States are changing laws

According to Wolters Kluwer, there’s also been significant state tax reforms of late that retirees and would-be retirees should try to follow. For instance, in South Carolina, a new deduction for military retirement income is now allowed and in Rhode Island, taxpayers who have reached the Social Security retirement age are eligible for a $15,000 exemption on their retirement income.

Don’t let the tax tail wag the retirement dog

Finally, Mengle says retirees and would-be retirees should certainly consider the tax friendliness of the states in which they might live. But they ought not do that in a vacuum. Instead, they should also weigh and prioritize other factors such as climate, crime rates, access to health care, proximity to friends and family and culture. Taxes is part of it, “but there are all kinds of factors” to consider, he says.

Robert Powell is editor of Retirement Weekly, contributes regularly to USA TODAY, The Wall Street Journal, TheStreet and MarketWatch. Got questions about money? Email Bob at rpowell@allthingsretirement.com.