Minorities are making effort to close retirement savings gap

It was the news that changed Derrick Harding’s perspective on financial planning forever. In 2014, Harding, a 70-year-old African American retiree in Miami, was diagnosed with leukemia. Then, he suffered a brain aneurysm and a severed artery during his hospitalization. “Luckily, I had insurance to cover the expenses, but it showed me that life can change in an instant and you have to be financially prepared,” he says.

It also taught Harding a lesson about the importance of talking about money with your family.

“Prior to the diagnosis, I had brief chats with my family about the importance of saving early and the dangers of overspending,” says Harding. Now, he has regular check-ins with his wife and three sons, and financial planning meetings with family members twice a year.

More on retirement:

Survey: We're stressed by retirement preparations – but doing little to prepare

How to improve your readiness for retirement

Retired women are more prone to financial crisis

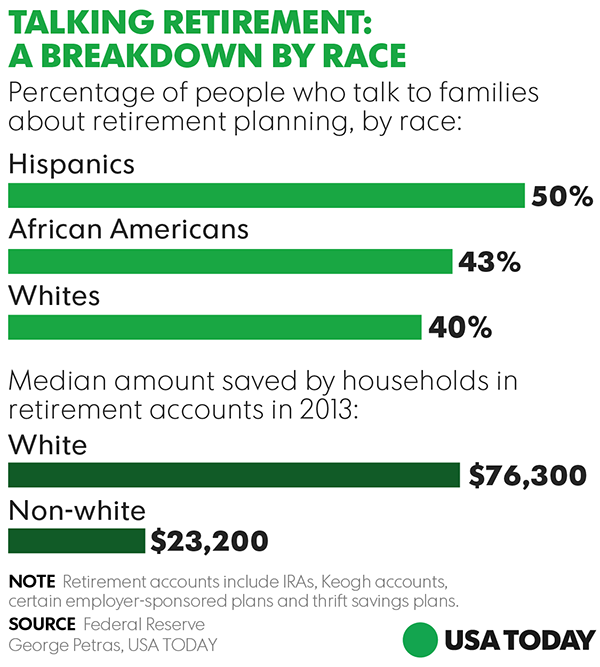

Harding is not alone in his quest to make financial planning conversations a priority among family members. According to an Ipsos/USA TODAY survey of 1,250 adults ages 45-65 conducted in mid-January, some minorities say they are actively discussing retirement planning with their families more than their white counterparts. In fact, 50% of Hispanics and 43% of African Americans polled report talking to their families about retirement planning compared with 40% of whites.

“It’s the evolution of time, education, opportunities, and access to information,” says Ivory Johnson, CFP, founder of Delancey Wealth Management in Washington, D.C. “Information levels the playing field.”

There’s more to the story. While some minority families are talking about financial planning more often, others are still trying to jumpstart the dialogue.

In the Indian community, for example, retirement planning conversations take place early and often. “The mindset is very different when it comes to money in the Indian family household,” says Divam N. Mehta, CFP, founder of Mehta Financial Group in Glen Allen, Virginia. Often, immigrants leave their homeland to succeed in the U.S., both for themselves and future generations. “From a young age, most parents are actively educating their children on the importance of money management with an emphasis on savings,” says Mehta.

Deborah Herrand, a 42-year-old Hispanic teacher and single Mom from Queens, New York, says it’s imperative to have these talks with your family. “Financial security gives you peace of mind. I am already having conversations with my young son about setting goals and making sacrifices to achieve his dreams,” she says. Despite giving her son money management tips, Herrand admits it’s still difficult to talk to her parents and siblings.

The hope among advisors and their clients is that having more money conversations, more access to capital, and improved money management habits, will eventually close a substantial wealth and retirement planning gap in America. According to figures from the 2013 Federal Reserve Board’s Survey of Consumer Finances, in 2013, white households saved a median amount of $76,300 in retirement accounts, compared to a median amount of $23,200 in nonwhite households.

For first or second generation minorities living in the U.S., talking about saving money initially took a backseat to earning it. “Many were just glad to get a paycheck. As times passes, the third, fourth, and fifth generation will learn how finances work and begin to progress,” says Herrand.

Roxanna McKinney, a financial representative at Strategies for Wealth, a financial planning company in New York City, agrees. “Almost all of my Latino clients refer my services to family members, while my white clients figure that their families are set, so they introduce me to a co-worker instead,” says McKinney. Among her Latino and Asian clients, there are also more consultations about having to care for aging parents. “We price the cost of care, life insurance, and other expenses into their savings goals so that it doesn’t affect their retirement,” says McKinney.

In African-American families, younger generations are having more money conversations than their parents did. “You mention the importance of having good credit to college kids, and they respond, “Of course I have to have good credit,” says Johnson. “Whereas my generation was talking about ‘How can I make more money?’ the younger generation is asking, ‘How can I build more wealth?’”

For Harding’s family, the money conversations changed their outlook on money. “Having money conversations with my oldest son resulted in him paying off his car when he was only 22 years old,” he says. In addition, his youngest son, now 37, only has a few more payments left on his student loans.

Having regular financial check-ins keeps the topic of finances top of mind. “When my family members are thinking about making a huge purchase, they think about our financial planning discussions,” says Harding. “The check-ins keep them accountable and that’s why it’s important to make them a habit.”