What a Fed rate hike means for you (get ready to pay more)

The Federal Reserve decision Wednesday to lift its benchmark short-term interest rate by a quarter percentage point is likely to have a domino effect across the economy as it gradually pushes up rates for everything from mortgages and credit card rates to small business loans.

Consumers with credit card debt, adjustable-rate mortgages and home equity lines of credit are the most likely to be affected by a rate hike, says Greg McBride, chief analyst at Bankrate.com. He says it’s the cumulative effect that’s important, especially since the Fed already raised rates in December 2015 and December 2016.

“These interest rate hikes could add up to hundreds of dollars per month in extra fees for credit card, adjustable-rate mortgage and HELOC borrowers,” McBride says.

The Fed’s likely decision to lift the federal funds rate, which is what banks charge each other for overnight loans, will have several effects on consumers. Here's how it may impact mortgage rates, auto loans, credit cards and bank savings rates:

Mortgages

The Fed’s key short-term rate affects mortgages and other long-term rates only indirectly.

Learn more: Best credit cards of 2023

Thirty-year fixed mortgage rates hit a 2017 high last week as the average jumped to 4.21% in anticipation of the Fed’s move Wednesday and another similar hike. That is up from a year ago when the average 30-year mortgage rate was 3.68%, according to Freddie Mac.

“For consumers currently shopping for a mortgage to purchase a property or refinance an existing loan,” says NerdWallet mortgage analyst Tim Manni, a Fed rate hike "shouldn’t feel like a real shock to the system since the rate move has already been 'baked' into the market.”

A third hike later this year could boost the rate by as much as another quarter-point or so, increasing the monthly mortgage payment on a $200,000 home by up to $30.

More on mortgage rates:

Fed rate hike: What it means for mortgage rates

Adjustable-rate mortgages, by contrast, typically are modified annually.

“Borrowers with adjustable rate mortgages that are seeing their rates reset should brace for higher payments. Because most ARMs only adjust once per year, the next rate reset could be a doozy if it encompasses 2 or 3 Fed hikes in the interim,” McBride says.

Adjustable rates, he says, could rise about three-quarters of a percentage point in that period, increasing the monthly payment of the $200,000 mortgage by $84.

Other factors may loom large in addition to future Fed rate hikes that will determine the direction of mortgage rates moving forward. If Congress fails to approve President Trump’s fiscal stimulus, for example, long-term rates could fall regardless of the Fed, while a faster-growing economy and higher inflation could drive up borrowing costs faster.

Auto loans

Typical five-year auto loans will be more directly influenced by a quarter-point increase in the Fed’s key short-term rate, with a 4.25% car loan rate rising by a similar quarter-point, or $3 a month, McBride says.

An increase Wednesday’ and two similar interest rate increases this year would increase the monthly payment for a new $25,000 car by a total of $9.

“Nobody will be downsizing from the SUV to the compact based on rising interest rates,” he says.

How rate hikes can affect your investments:

How to position your portfolio for rate hikes

Fed rate hike: 7 questions (and answers)

Credit cards and home equity lines of credit

Revolving loans with variable rates, such as credit cards and home equity lines of credit, will become more expensive since they feel the most immediate impact from an increase in the Fed’s key short-term rate.

Average credit card rates are about 16.26%, while home equity lines are about 5.21%, according to Bankrate.com.

Banks should pass along quarter-point increases in the federal funds rate to those consumer rates within weeks.

More on rates and credit cards:

4 things credit card holders can do to get ready for a rate hike

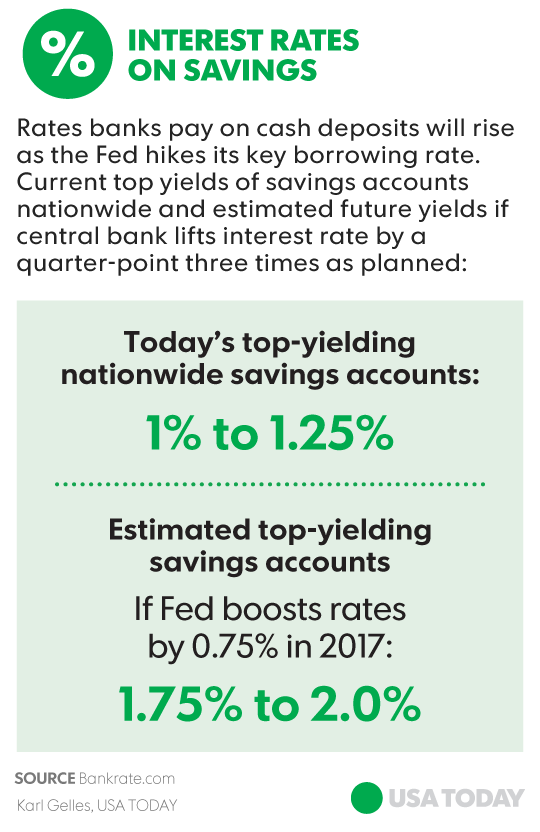

Bank savings rates

Since banks will be able to charge a bit more for loans, they’ll have a little more leeway to pay higher interest rates on customer deposits. Don’t expect a fast or an equivalent rise in your savings accounts or CD rate though.

“Still not a whole lot of improvement for savers to count on the third time around,” McBride says.

Low interest rates have spelled narrow profit margins for banks for years. They have an opportunity to benefit from a bigger margin between what they pay in interest and what they earn from loans.

“But your odds – and your rate of return – go up dramatically if you are seeking out the top-yielding offers from banks that are willing to pay more in order to bring in deposits. They’re also the most likely to raise rates in an effort to remain competitive,” McBride says.

NerdWallet credit and banking analyst Sean McQuay advises you should search for a higher-yield savings account.

“Saving in a high-yield versus low-yield account would earn Americans $5.6 billion more per year in savings account interest,” McQuay says. A high-yield savings account pays about $275 more per year than a low-interest account on savings of $25,000, according to NerdWallet.

More on banks and savings rates:

Fed rate hike: What it means for your CDs

If the Fed can, so can you: Hike your savings rate

How will higher interest rates help Bank of America?