Lyft faces its big moment to leap ahead of Uber

SAN FRANCISCO — Is this Lyft's moment to really lift off?

Uber, the company's larger ride-hailing rival, has been hit with a string of bad press lately related to a misbehaving CEO, claims of sexist supervisors, a report it deceived law enforcement and a lawsuit overallegedly stolen intellectual property.

And that's all after a #DeleteUber campaign related to Uber's initial response to President Trump's immigration travel ban led many to dump the service.

“Lyft is seeing some openings and they’re making the most of them,” says Karl Brauer, executive publisher of Autotrader and Kelley Blue Book.

Despite being the underdog in this fight, Lyft President John Zimmer told USA TODAY months ago that his mission was to own the U.S. market and let Uber take the rest of the world. This would seem an opportune time for Zimmer and his team to make big strides.

The service recently announced that it had opened 96 new markets this year, bringing its total to 300 cities. And the company is raising $500 millionto turbocharge its efforts, according to a person familiar with the effort who was not authorized to speak publicly.

Lyft is gaining

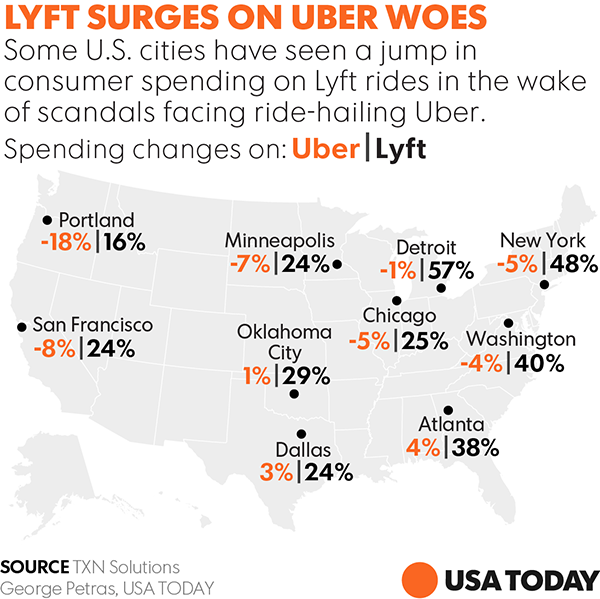

Spending data suggests Lyft already has received a discernible bump from Uber's ongoing issues.

The week before the #DeleteUber campaign in late January, Uber had 83.5% of the ride-hailing market and Lyft had 16.5%, according to TXN Solutions, which tracks debit and credit card spending.

But Uber's troubles resulted in market share gains for Lyft, which had 20.9% of the market following #DeleteUber. It got another bump to 21.3% after Uber ex-engineer Susan Fowler's incendiary February blog post alleging blatant sexism at the company.

The decline in Uber's market share was consistent in all four of its top markets: New York City, Washington, D.C., Los Angeles and the San Francisco Bay Area, TXN found.

At the same time, spending nationwide on Uber in the four weeks after Jan. 30 declined 2% compared to the prior four weeks, while Lyft spending jumped 30%. The #DeleteUber campaign gathered momentum on Jan. 30 after a weekend of protests against the travel ban.

Former Uber user Marian Baldauf says she was bothered by stories about Uber’s aggressive corporate culture, but the service was so convenient that she didn’t take action.

That changed when she read Fowler's Feb. 19 post. “When I read that woman’s blog it was just so deeply offensive and so wrong in so many ways that I just couldn’t do it anymore," says Baldauf. "So I switched to Lyft. I’ve taken two rides since and they’ve been wonderful."

Asked for specifics on Lyft's plans given Uber's dilemma, Lyft spokesperson Alexandra LaManna said, "we have always been guided by the same set of business strategies and values ... none of that has changed."

Lyft's narrower focus an advantage

Momentum at least appears to be on Lyft's side. The company says it tripled its ride count last year to 162 million from 53 million in 2015. Lyft has 700,000 active drivers, or double that of a year ago. And it has dispensed $150 million in tips to drivers, an in-app option not available to Uber drivers.

![Uber_self_driving [image : 98838508]](http://www.gannett-cdn.com/media/2017/03/06/USATODAY/USATODAY/636244408479517060-636209680511270784-forduber.jpg?width=660&disable=upscale&format=pjpg&auto=webp)

In fact, a survey of drivers compiled by TheRideShareGuy.com, a blog for drivers, said 76% of them were satisfied with their Lyft driving experience compared to just under 50% on Uber.

Also in Lyft's favor is that the company is not spending inordinate resources on self-driving car technology, something Uber has done since establishing its Uber Advanced Technologies center in Pittsburgh. Uber currently is facing a lawsuit from Alphabet-owned Waymo, which contends that Uber-owned Otto has self-driving truck sensor technology that was stolen. (Uber has called the suit "baseless.")

But if Uber is the heavyweight boxing champion on the ropes, Lyft is the gutsy featherweight that's punching far above its class.

Uber, which declined to comment for this story, may have mounting brand image issues, but at a $70 billion valuation it is roughly ten times the size of Lyft. Uber is in nearly 600 cities in 81 countries.

By some metrics, it's doing just fine: Downloads of the Uber app in the past few weeks have been higher than average, according to analysis firm Mobile Action.

And whether due to the ubiquity or efficiency of its service, Uber's name is on a fast track to becoming the Xerox of ride-hailing terms.

Given Uber’s massive head start, it would take an “ongoing series of this kind of mistake for it to really fall from its global leadership position,” says Autotrader's Brauer.

Gartner analyst Michael Ramsey says that Uber's woes are likely to provide an opening for Lyft and other ride-railing companies, which include Juno in New York City,

mytaxi (formerly Hailo) in Europe and Didi Chuxing in China and Brazil.

![Didi_Chuxing [image : 98838548]](http://www.gannett-cdn.com/media/2017/03/06/USATODAY/USATODAY/636244411506287266-EPA-CHINA-APPLE-DIDI-CHUXING-81826315.jpg?width=660&disable=upscale&format=pjpg&auto=webp)

That said, riders "won't make a switch if they don't have comparable (driver) response times to Uber," says Ramsey. "So the constituency that needs to come to Lyft for it to really grow is drivers."

Not a winner-take-all battle

The good news for all of them is that ride-hailing isn’t necessarily winner-take-all. It’s very common for drivers to use more than one ride-hailing service to generate work, and for consumers it’s trivial to have multiple ride-sharing apps, said David Evans, co-author of Matchmakers: The New Economics of Multisided Platforms.

“If I had to make a guess in this business, I’d say we’re not going to see ten of these guys survive, particularly because of the economics of density. But we could certainly see two or three of them in major cities,” said Evans.

Ride-hailing services live and die by two things: having enough drivers and passengers. Uber could be hurt if enough drivers stop driving for it because they feel they might get a better deal elsewhere. And certainly passenger defection could make its mark, especially if those flames are fanned by social media.

Some riders ready to switch

Caroline Pincus was angered by stories about Uber drivers trying desperately to drive enough hours to make a decent living.

“The whole ‘set your own hours, be your own boss’ come-on seems like classic anti-worker, deceptive, (and anti-union) exploitative horse----,” she says.

After talking to Lyft drivers, her impression is that the company treats them better than Uber.

“Lyft does a better job of vetting its drivers, actually inspects vehicles before signing them on, and is fairer with payout to drivers,” says Pincus.

Axel Soriano of San Jose, Calif., got upset with Uber "after the whole JFK incident," when the company continued to operate at the New York airport despite calls to support a one-hour taxi strike in support of anti-immigration protesters.

Although he deleted the Uber app then in response to the social media campaign, Soriano adds that the recently surfaced video of Kalanick ranting against a driver, which added to the internal and external condemnation of the company, would have put him over the edge.

"I didn’t think it was really right, how he treated his employees,” he says.

Such sentiments could tilt momentum in Lyft's way. The company has "an amazing opportunity to lift themselves up to get ahead,” says Julie Chase, corporate practice group chair at Levick Communications in Washington D.C.

The key is that Lyft has to avoid Uber's mistakes and burnish its public image as the "nice" ride-hailing company.

“They are currently not besmirched with any indiscretions,” Chase says. They need to "continue on the path of disclosure, workplace non-discrimination and all around good behavior.”

Contributing: Jessica Guynn

![Lyft looks to raise $500M as Uber stumbles [oembed : 98799834] [oembed : 98799834] [oembed : 98799834] [oembed : 98799834] [oembed : 98799834] [oembed : 98799834] [oembed : 98799834] [oembed : 98799834] [oembed : 98799834] [oembed : 98799834] [oembed : 98799834] [oembed : 98799834] [oembed : 98799834] [oembed : 98799834] [oembed : 98799834] [oembed : 98799834] [oembed : 98799834] [oembed : 98799834] [oembed : 98799834] [oembed : 98799834] [oembed : 98799834] [oembed : 98799834] [oembed : 98799834] [oembed : 98799834] [oembed : 98799834] [oembed : 98799834] [oembed : 98799834] [oembed : 98799834] [oembed : 98799834] [oembed : 98799834] [oembed : 98799834] [oembed : 98799834] [oembed : 98799834] [oembed : 98799834] [oembed : 98799834] [oembed : 98799834]](/Portals/_default/Skins/PrestoLegacy/CommonCss/images/smartembed.png)

![636239138790586596-Travis.JPG [image : 98557558]](http://www.gannett-cdn.com/-mm-/53fb39d82f2e552aeed559a13afdf1c40e785a38/c=8-0-1015-861/local/-/media/2017/02/28/USATODAY/USATODAY/636239138790586596-Travis.JPG?width=660&disable=upscale&format=pjpg&auto=webp)