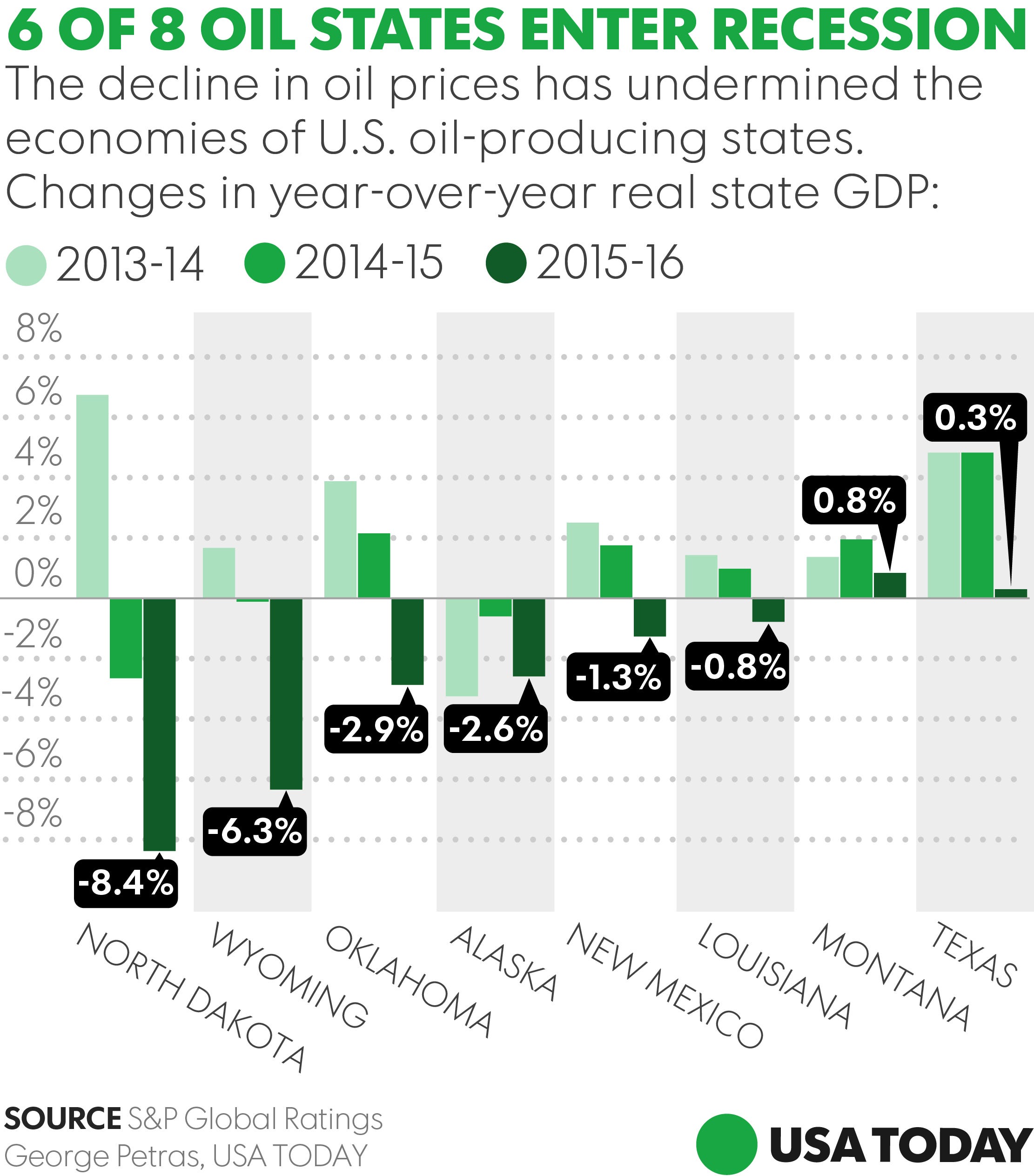

Six of the eight top oil-pumping states hit recession

America's economy is looking solid overall these days, but depressed prices for domestic oil production tipped six of the eight biggest oil-pumping states into recession last year, according to a new report.

As oil prices dipped as low as $27 a barrel at one point early last year before recovering, recession came to Alaska, Louisiana, New Mexico, North Dakota, Oklahoma and Wyoming, according to the S&P Global Ratings report.

The report, illustrating the damaging effects of the global commodity's slide on American energy, found that Texas and Montana barely avoided recession with slight increases in growth.

Seven of the eight states ranked in the bottom 10 in job creation, with only Texas, at No. 23, escaping that dubious distinction. Employment opportunities, state budgets and economic growth have contracted, accordingly.

OPEC agrees to oil production cuts

The development comes as the energy industry hopes for action by President Trump to open up new federal lands for production and lift environmental restrictions on pumping. But those prospective moves, while potentially helpful for long-term growth, could portend short-term challenges if they spark further price declines.

The pain is particularly sharp in states like North Dakota. The state' was at the forefront of the upswing in American oil and gas production over the last several years, but has taken a sharp turn for the worse. North Dakota lost 2.9% of its jobs in 2016 and its economy shrunk by 8.4%, according to the S&P report.

"Certainly we’ve seen that decrease as we’ve dealt with a difficult market," said Tessa Sandstrom, communications manager at the North Dakota Petroleum Council. "But we’re still well ahead of where we were in 2006 which was the official, unofficial" start of the boom.

Sandstrom says the industry views Trump's election as providing "more stability" for producers. "That definitely adds a little encouragement," she said.

In Oklahoma, the state budget is expected to take a significant hit as tax receipts suffer. More than 13% of household earnings in Oklahoma come from the energy sector, up from 6.9% in 2001, according toreport released in September by the State Chamber of Oklahoma.

The good news for the industry is that Organization of Petroleum Exporting Countries' oil-pumping cuts helped stabilize the commodity after prices cratered amid a global glut of production. West Texas Intermediate closed Tuesday at $53.06 a barrel, up 31 cents or 0.59% for the day.

Plus, there's a general consensus that energy companies have dramatically slashed their costs in which several dozen producers filed for bankruptcy and laid off thousands of workers, which could make them more profitable.

"With oil prices appearing to have hit bottom and now stabilized somewhat, we anticipate a leveling off of economic performance among the oil-producing states," S&P credit analyst Gabriel Petek said in the report. But "we expect any economic recovery to be modest."

How each state is faring:

Alaska

Gov. Bill Walker has said a new tax, such as an income tax or sales tax, is "likely going to be necessary" to offset a budget shortfall, according to S&P. The state has significant budget reserves, however.

Montana

With economic growth of 0.84% in 2016, Montana fared best of all eight oil states. Its job creation rate of 0.46% was second best.

Although oil and gas income made up only 2.2% of the state budget in the current two-year fiscal cycle, it's expected to fall to 1.9% for the next period.

Louisiana

Oil's struggles have pummeled the state's budget, with forecasters recently projecting a $300 million decrease in revenue "as ongoing employment weakness in the oil industry has continued to affect individual and corporate income tax collections," S&P reported.

Although the state's offshore oil rigs offer more flexibility -- easier to start production and easier to shut down -- than shale drilling projects on land, the job outlook remains tepid.

"Although oil prices have somewhat rebounded, state officials report that in order for the employment situation to improve, a long-term bounce in production is

required," S&P reported.

New Mexico

This state's oil and gas industry cut 26.5% of its jobs in the 12-month period ending in October. Under current projections, without mid-year changes the 2017 fiscal year would end with a negative fund balance.

North Dakota

Crushed by oil's rough 2016, North Dakota expects to have $1.4 billion less in next two-year budgeting cycle than it had projected two years ago. The state's rate of job losses was second worst in the country.

The state's strong budgetary reserves may help off set some of the pain, but S&P warned that using reserves to balance the budget instead of slashing spending "could lead to credit pressure."

Oklahoma

The commodity's slump has dealt a sharp blow to Oklahoma's bottom line. The state is currently projected to have 12.6% less spending capacity in its 2018 budget than it has in its 2017 budget.

"Given our overall assessment that Oklahoma is markedly vulnerable in the event of a U.S. downturn, and that management has yet to demonstrate a sustainable path toward improving the state's financial position, even modest economic softness could have prolonged negative effects," S&P said.

Texas

The state's increasingly diversified economy has made it arguably the most resilient of the oil states, as it maintains its pristine AAA credit rating. Employment grew at a rate of 1.6% in 2016, more than triple the next-best rate among oil states.

Sales taxes are down and spending on public assistance is up. But with a rainy-day fund of more than $10 billion and oil production taxes representing only 4.3% of the budget for the next cycle, the state finances are in solid shape.

Wyoming

The state is expected to draw down on its sizable budget reserves to make ends meet. Coal's decline is more damaging to this state than oil's slide.

Employment fell 3.2% in 2016, the worst rate of all 50 states.

Follow USA TODAY reporter Nathan Bomey on Twitter @NathanBomey.