Do you know how much you're paying in 401(k) fees?

As employer-sponsored pensions become less common, the most popular way for Americans to save for retirement these days is with a 401(k). According to a recent study by the Investment Company Institute, there was $4.4 trillion in assets across 52 million active participants.

But while many people may have a 401(k), most have no idea how much their plan may be costing them.

One study done by AARP back in 2011 showed that 71% of participants thought that they didn’t pay any 401(k) fees — something that simply isn’t true.

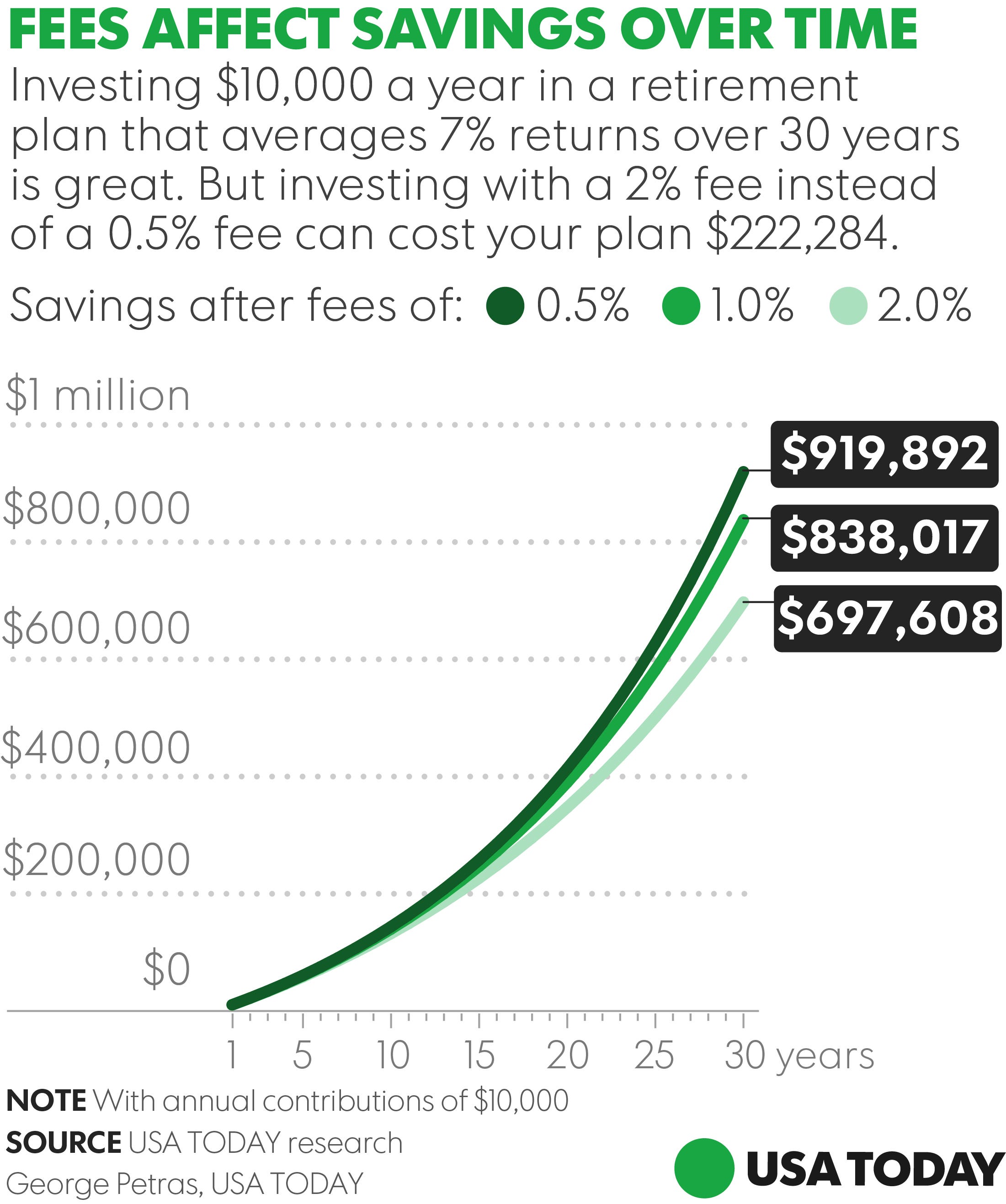

There are a host of different charges that can seriously eat away at your nest egg, even though they may not sound burdensome on the surface or be obvious on your statement. Let’s say, for instance, you save $10,000 a year for 30 years in your 401(k). If you average 7% returns annually and pay 0.5% in annual expenses, you’ll finish with about $920,000 saved. However with 1.0% in annual fees, that total drops to a little less than $840,000 — and if you suffer 2.0% in annual fees, your finishing total is just under $700,000.

One percentage point really starts to add up when you do the math. And that means paying your fees — which should be disclosed to either you or your employer in some way under current labor law.

“It’s not really that the fees are hidden," said Tom Zgainer, founder and CEO of America’s Best 401k, an investment firm that audits company retirement plans. “It’s more that they are hiding in plain sight.”

How to build a multimillion-dollar retirement fund

Steps you can take to reduce fees

The biggest thing you can do to keep 401(k) costs down is pay close attention to your investment choices — particularly the fee charged by the mutual funds your plan profits.

These fees are commonly expressed in a percentage as “expense ratios.” And while a nominally small annual fee like 1.1% may sound good at first glance, it adds up to big money on a significant nest egg — for instance, a whopping $5,500 each year on $500,000 portfolio.

There’s no free lunch, of course, but a good number to remember is that the average expense ratio was just 0.64%, according to a 2015 fee study by investment research firm Morningstar. Many funds, particularly low-cost index funds, come in significantly lower than that.

Unfortunately, however, 401(k)s typically provided a limited menu of funds, and participants are stuck with that list. Additionally, above all those funds could be expensive administrative fees that are determined at the plan level, and are out of an individual employee’s control.

“You are, unfortunately, stuck using the provider your employer has chosen,” said Zgainer or America’s Best 401k. “Whether it's high-expense ratio funds or additional asset-based fees layered on, that goes across every participant in the plan. … There’s just nothing you can do about it.”

That doesn’t mean you can’t do some digging on behalf of your plan administrator, he said. Though America’s Best 401k serves employer-benefits departments, Zgainer said he regularly hears from some employees looking into things on their own.

“The participants do have a voice, because an employer is required to do a benchmark of their existing providers on a regular basis,” Zgainer said. “If they can measurably improve the 401(k) for the good of everybody, it has to be a consideration.”

5 things to do 5 years before retiring

This might include something like reducing administrative fees from a percentage of total assets to a fixed fee per participant, or removing high-fee investment options for similar ones that are cheaper.

In fact, he adds that oftentimes the executives or owners in charge of a 401(k) plan are eager to take up the cause once an employee brings it to their attention — often for selfish reasons since they have an even bigger nest egg at stake than the rank and file.

“It’s not that they’re not well-intentioned,“ Zgainer said. “It’s just that they’ve never seen data put together where it shows the true ramifications of their choices.”

If you can’t make changes at the plan level and are stuck with an expensive 401(k) plan, however, don’t be afraid to just move your money to alternatives such as a low-cost IRA.

“A balance to that conversation might be that the employer is providing a company match, and that consideration is a prevailing factor,” Zgainer said. “I would suggest you defer whatever you can to get the totality of the company match and then consider putting any extra dollars you’d have available in an IRA to keep your cost down there instead.”