Obamacare rate hikes rattle consumers, could threaten enrollment

Many of next year's premium rate increases on the Affordable Care Act exchanges threaten to surpass the high and wildly fluctuating rates that characterized the individual insurance market before the health law took effect, interviews with insurance regulators and records show.

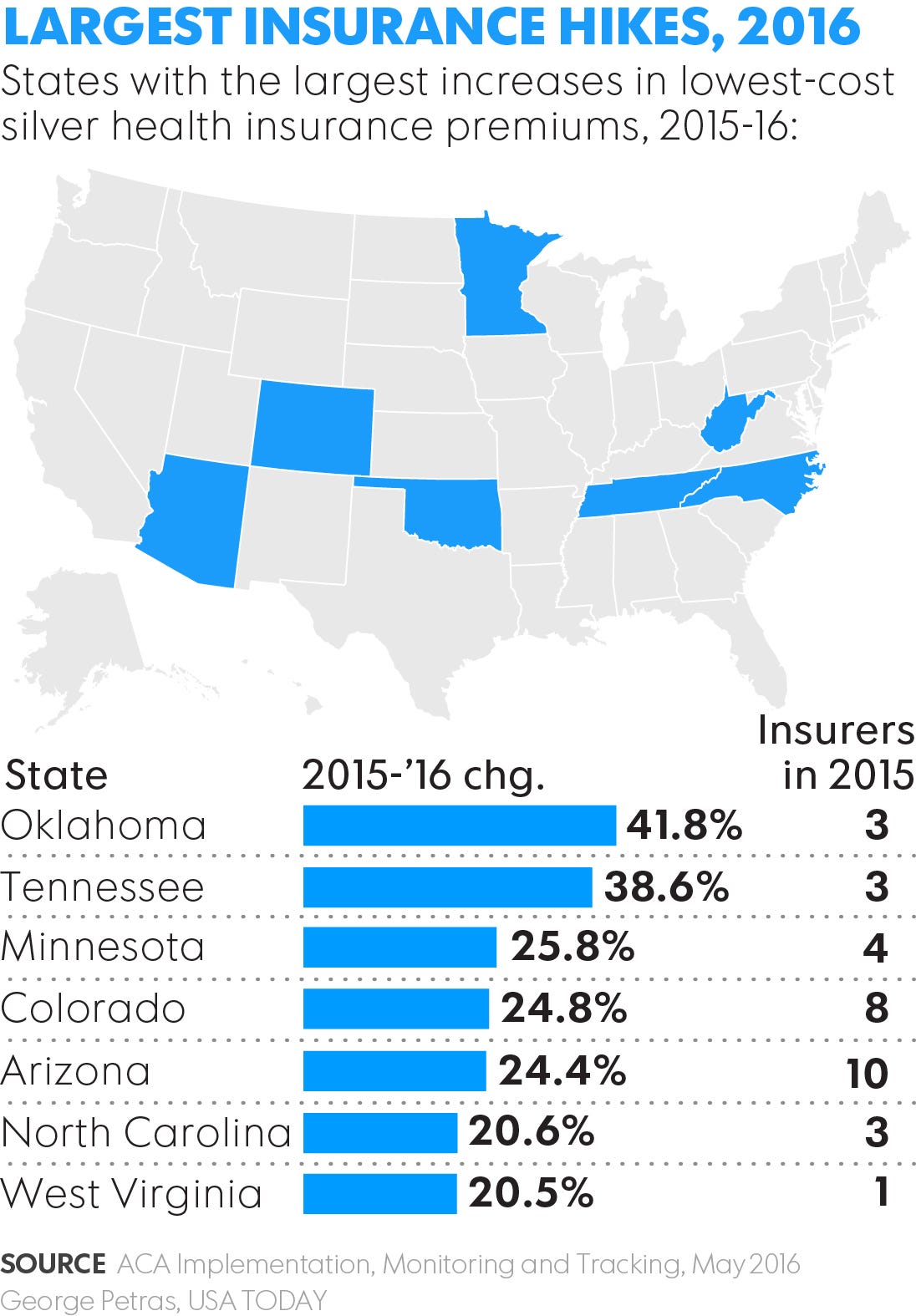

With dramatic drops in insurance company participation on the exchanges for some states, decreased competition and other factors are leading to often jarring rate hikes. Some of the states that are facing what are likely among the biggest increases this year — Tennessee, Arizona and North Carolina — were among those the Urban Institute reported in May had the biggest increases last year.

“The reality is, it’s all very justified, unfortunately,” Iowa insurance commissioner Nick Gerhart said Thursday of the premium increases he approved this week of 19% to 43% for about 70,000 Iowans who buy their own policies.

Gerhart warned consumers in a rate hearing in July that if he rejected insurers’ proposed premium increases for 2017, the carriers would likely decline to sell policies in the state. No carriers made an explicit threat to leave Iowa, but the implication was clear, he says: “It gives you less room to maneuver." Iowa law, he said, requires him to judge proposed premium increases on whether experts find them to be justified by carriers’ projected costs

As other state insurance commissioners gradually sign off on insurers' rate requests — which should all be decided within a month — many consumers are learning what's in store for 2017.

Prep for the polls: See who is running for president and compare where they stand on key issues in our Voter Guide

Issues with the exchanges consumed a "disproportionate amount of attention" at the National Association of Insurance Commissioners' summer meeting, which ended Monday, said John Huff, the group's president.

The individual health insurance market is typically one of the smallest parts of commissioners' focus even with health insurance and they also have to deal with far more sweeping issues including property and casualty insurance and medical liability.

"Clearly, state and federal policymakers need to continue to work together (toward) a more stable risk pool, certainty on funding and more reasonable regulations," says Huff, who is also director of Missouri's insurance office. "Over six years after the law was passed, making substantive corrections to the law is past due and, consequently, the markets are suffering."

Insurers need enough healthy people in the "pool" of consumers enrolled in their plans to offset the financial risks in covering the sick ones who need costly care. A shortage of healthy consumers on the exchanges to date is often attributed to the high premiums and relatively low tax penalties so far for remaining uninsured.

Health and Human Service Department Secretary Sylvia Burwell said Thursday the insurance exchanges "can be made sustainable in the long term" though administrative actions by the agency, but legislative action could "speeds things up."

Insurance premiums are probably still lower than they would have been if the Congressional Budget Office's early high projections played out, Burwell said. She added that it's important to consider the Affordable Care Act's overall effect on Americans, including those who have employer-provided coverage rather than just the 11 million people enrolled in insurance through the exchanges.

Legislators spar over Obamacare rate hike

But while that's some solace for people including breast cancer survivor Christine Frietchen of New York City, she just got a letter from Empire Blue Cross Blue Shield saying she faces a 22% rate increase for 2017. That will bring her premium to more than $630 a month for a silver-level plan that only covers in-network care and requires referrals for everything.

"No doubt, out-of-pocket maximums and co-pays will also increase as they say there will be 'changes' in the letter, but they don't specify what those will be," says Frietchen, who works for a nutritionist and author. "I'm certain the rate hike is the tip of the iceberg."

Many argue that premium costs — even when heavily subsidized by the government — are too high. The health law considers it affordable if insurance premiums cost 6% or less of income for those earning under 200% of the federal poverty limit, or about $40,000 for a family of three,

"That's really, really asking a lot," says John Holahan, a fellow at the Urban Institute's Health Policy Center. "The way it was designed, it was almost destined to not work.".

Holahan, co-author of the recent Urban Institute report, found the number of insurers, the level of 2015 premiums, and the types of insurers participating within the markets were the major factors influencing whether there were premium increases or decreases. The report concluded "there is no meaningful national average," and the wide variation state to state is tied directly varying levels of competition around the country.

In Tennessee, the insurance commissioner signed off on average rate increases of 59%, but Holahan says it's important to consider the proportion of population affected by rate increases. Urban areas often have strong competition and lower rates.

In middle Tennessee, where Lori Woodard-Hoyt does health care consulting that includes insurance assistance to doctors, she says many consumers are choosing to remain uninsured — especially considering the challenges many face finding in-network specialists in their rural areas. With high-deductible plans, others also can't afford to pay what they owe when go to the doctor.

In Delaware, Gavin Braithwaite and his wife Lou are facing a proposed 32.5% increase in their Highmark Blue Cross Blue Shield plan for 2017, which is especially painful as it comes on top of a more than 55% increase in 2016 and a nearly 24% hike in 2015.

"Already our retirement savings are being severely impacted," Gavin wrote to his state senators and other officials this week. "Where will this trend leave us in 2018 and beyond?"

Braithwaite says he wants to stay with the plan, which covers just his wife as he's on Medicare, because it's "a lot of aggravation" to change plans and possibly doctors and they have been with Highmark for nearly 10 years.

Gina Brodie of Tucson bought an individual policy for about a decade before the ACA and says she's fed up with increasing premiums. Brodie and her husband have been paying more than $900 a month for an gold-level plan they bought on Healthcare.gov even though she gave up trying to find a primary care doctor who would accept her insurance over the summer.

With all but two insurers expected to leave her county for 2017 and the state insurance commissioner questioning how much leverage he has given the departures, Brodie and others in her state are wondering how they will afford insurance and what it will be worth next year.

"It is quite infuriating to read about how all the insurance companies are losing money, when we rarely, if ever, have utilized our many insurance plans over the years," says Brodie, who has a form of chronic arthritis that she would like treated. "Those insurance companies have made nearly 100% profit on us, while we got either zero benefits or zero access to the system."

Frietchen, who is single and 46, says she'd likely be paying far more for private health insurance coverage, or "I would not have been able to take a job with a startup that I really love, but that's too small to offer a health care benefit."

"We're dealing with Obamacare version 1.0 here," says Frietchen. "I never expected it would be perfect right out of the gate, and I hope that our next president focuses on refinement, revision and review, rather than repeal."

Huff says the next few months will determine much about the reputations and priorities of insurers. Those who want policies that take effect January 1 need to sign up by Dec. 15.

"Consumers may not realize until December 15 that there’s no one here in the market and may ask the question: 'Where were the insurers when consumers needed them?'" says Huff. "That’s a potential reputational risk for health insurers."