Drug prices are high. So are the CEOs' pay.

People might be shocked at how high drug prices have gotten. But equally lucrative are the compensation packages hauled in by drug company CEOs.

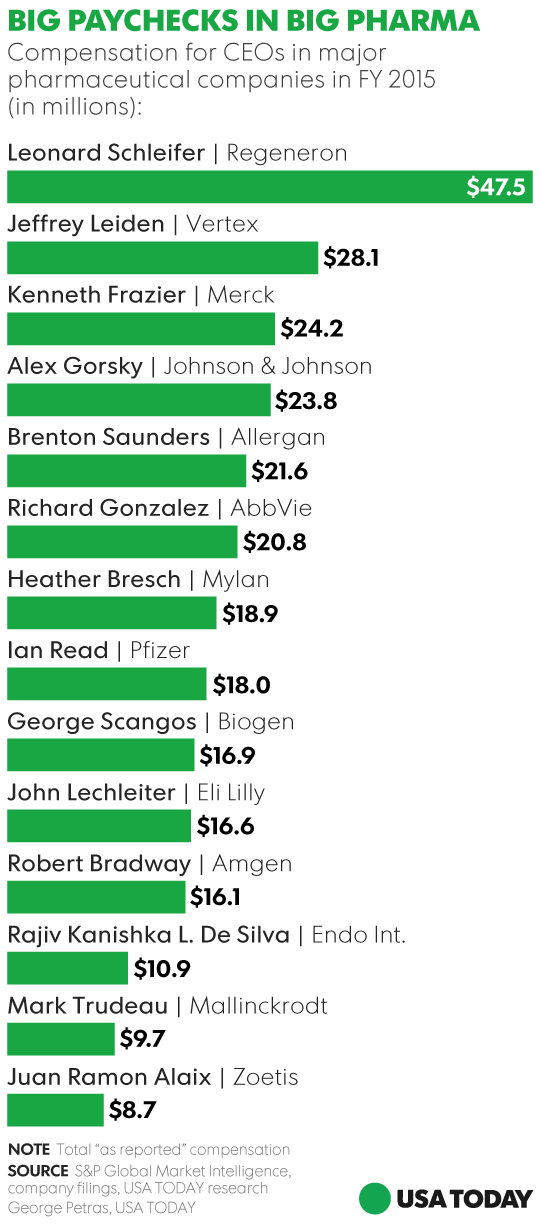

CEOs of the 14 biotech and pharmaceutical companies in the Standard & Poor's 500 that served all of 2015 pulled down median compensation packages valued at $18.5 million in 2015, according to a USA TODAY analysis of data from S&P Global Market Intelligence. That was 71% greater than the median $10.8 million hauled in by S&P 500 executives in all industries in 2015, according to an analysis by Equilar.

"We all know drug prices are high," says Eleanor Bloxham, CEO of compensation analysis firm The Value Alliance. "Companies award (the CEOs) very generous packages." Health care CEOs received the highest median pay packages of any of the 10 sectors, according to the Equilar analysis.

Seeing such staggering pay packages for the titans of companies producing life-saving drugs stands out as lawmakers take a closer look at prices for drugs. Most recently, Mylan (MYL) found itself in the center of the controversy over drug prices following its roughly 500% increase in prices for its popular EpiPen allergy drug since 2007. Heather Bresch, who has been CEO of Mylan since early 2012, was paid $18.9 million last year, well above the median for the S&P 500 and up 109% since 2013.

Mylan isn't alone: 11 drugmakers with off-the-charts pricing power

But Bresch is far from being the highest paid among the ranks of drug company CEOs. Leonard Schleifer, CEO of biotech Regeneron Pharmaceuticals (REGN), wins there. He was awarded a compensation packaged valued at $47.5 million last year. The 63-year-old executive has been CEO of the company since 1988 and got a 13% raise in his total pay last year. The company makes treatments for a number of serious medical conditions, including its drug to deal with macular degeneration. The company's pay has been subject of controversy before. Investors can vote on the suitability of the company's compensation plan every three years. In June 2014, only 62% of shareholders approved of the 2013 compensation plan. In its proxy statement released this year, the company says it has "spent a significant amount of time speaking with some of our key shareholders about executive compensation" and says it has made modifications.

Jeffrey Leiden, CEO of Vertex Pharmaceuticals (VRTX), is the drugmaker CEO with the next largest compensation package. Leiden, 60, has been CEO of the company since 2012 and pulled down $28 million last year. Last year, investors expressed less confidence in the company's pay structure causing the company to respond, "we increased our level of engagement in response to the decline in support for our advisory say-on-pay proposal at our 2015 annual meeting." A say-on-pay proposal is a non-binding vote to allow investors to say if they approve of the way executives are paid. The company, in its proxy statement, says, "we have designed the company’s compensation programs to closely align management’s incentives with Vertex’s strategic long- and short-term goals and with the interests of Vertex’s shareholders."

While drugmaker CEOs might get paid more than the typical CEO, last year wasn't a great one for raises. CEOs at the 13 biotech and pharmaceutical companies in the S&P 500 who served both 2014 and 2015 saw their median pay fall nearly 19%. That's a much steeper drop than the 5% decline experienced by S&P 500 CEOs in 2015, Equilar says.

Meanwhile, shares of drug companies were flat last year on average and this year they're down 6.3% as investors worry about the sustainability of profit growth and rumblings from Capitol Hill about drug prices. "Considering how fast medical costs are rising, this is becoming a public policy issue," Bloxham says.