Can an annuity act as your pension plan?

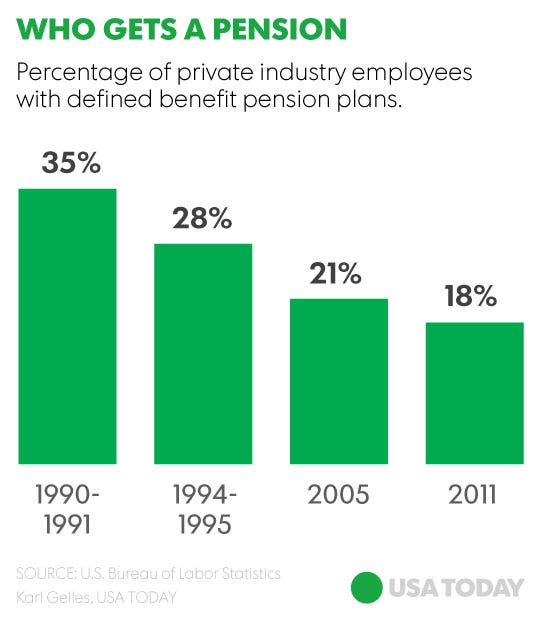

Retirement planning has changed a lot over the last few decades. And perhaps one of the most dramatic changes is the slow and steady death of employer-provided pensions.

According to Bureau of Labor Statistics data, only 10% of private employers offered defined benefit retirement plans in 2011 to cover just 18% of America’s private-sector workers. Just 20 years prior, back in 1981, more than 80% of private workers were covered.

The reason for the shift is simple: Pension plans are very costly for businesses. So, the private sector has largely transitioned to 401(k) plans for its workers instead — which has resulted in plenty of new challenges, including the need for Americans to take charge of their investments as well as the rate of their retirement savings.

“Nobody ever complains about their pension. The reality is that Americans never wanted to go to 401(k) plans, but they went there because companies couldn’t afford to offer pensions anymore,” said Chris Blunt, president of the investments group at New York Life.

For those who don’t have the backstop of a traditional defined-benefit pension plan, however, annuities could be an attractive way to re-create the kind of guaranteed retirement income most Americans enjoyed in decades past.

“Annuities make it so you can still have a pension,” Blunt said. “But you have to pay for it differently.”

What kind of annuity could work for you?

The basic feature of an annuity that makes it attractive to savers is the promise of a guaranteed income stream for the rest of their lives. Commonly, you pay a lump-sum “premium” as an initial investment, and then your annuity pays back a predetermined amount on a set schedule until you die.

That kind of certainty is hard to replicate with other investments, which can fluctuate in value or income potential over time.

“If you think about it, the most important fact to know to do proper retirement income planning is the only unknowable fact. I don’t know what time frame we’re dealing with,” Blunt says.

“If you told me you had an appointment to die promptly on your 72nd birthday, I could optimize your portfolio perfectly,” he jokes.

Conservatively oriented investors tend to be drawn to the pension-like features of an annuity. But it’s important to note that there is no standard form for these investments, and different forms of annuities come with different risks.

The basic forms of annuities include:

• Immediate vs. Deferred. An immediate annuity is exactly what sounds like: You deposit your investment and start getting paid back right away. A deferred annuity, on the other hand, starts paying you back at a predetermined date in the future. If you don’t need the money right away, deferring your payments can result in better payouts. For instance, Blunt at New York Life offered the example of a 70-year-old man investing $100,000 in an immediate annuity and getting 6.4% for the rest of his life, or $534 per month. By contrast, a 53-year-old depositing that same $100,000 amount in a deferred annuity could get a 7.2% annual return or $599 per month — but those payments would not begin until he reaches age 60.

• Fixed vs. Variable. A fixed-rate annuity is where a provider pays you a fixed return on your initial investment across a specific time frame, without any risk of changes in the future. A variable rate annuity, on the other hand, will see its payments fluctuate based on the underlying investments or overall interest rate environment. Both have risks, because while payments from your fixed-rate annuity won’t ever change, the product also does nothing to protect you against inflation if prices rise significantly and erode your purchasing power. While a variable-rate annuity may see payouts drop thanks to poor performance, it also may allow your income to rise and keep pace with the cost of health care, food or other expenses in decades to come.

• Equity-Indexed Annuities. These vehicles are relatively new, and a response to low interest rates. Providers usually explain them as hybrids, with some kind of guaranteed minimum like a fixed-rate annuity return but with the potential for bigger payouts if the underlying investments perform well. Of course, the guaranteed minimum payments are generally lower than a standard fixed-rate annuity — and frequently, these vehicles can be complicated, opaque and charge high fees depending on the underlying investments. These instruments aren’t categorically bad and have their place in some portfolios, Blunt said, but it’s always important to read the fine print.

There are a host of other options out there for those interested in annuities, including annuities that pay a guaranteed death benefit like life insurance or even plans that allow you to pay your premium on a schedule instead of in a lump sum.

That means, as with so many financial products out there, it’s important to think about your personal finances and your retirement goals before deciding whether one of these products is right. But one way or another, you have to answer the question of where your income is going to come from in retirement.

“In its purest form, an annuity is the idea of taking a portion of my assets and turning it into a lifetime income stream,” said Blunt of New York Life. “That’s an incredibly appealing idea to people who don’t have the guarantee of a pension plan.”

Jeff Reeves is executive editor of InvestorPlace.com.